|

from The Worldview Literacy Book copyright 2009 back to worldview theme #19 |

| Discussion

Economic systems involve individuals, socioeconomic and political

institutions within the society producing, distributing, and consuming

goods and services, deciding questions of ownership, and allocating

economic resources (and their costs and benefits).

How these functions are handled depends on the particular system:

capitalism, collectivism, socialism (theme #49B), co-operative

(participatory) economics (theme #48) and combinations or variations of

them.

Economic Individualism is linked to free market use of

capital—which can take the

physical form of money, raw materials, buildings, equipment,

inventories, etc. or the human form of skills, abilities, know how, etc.

While economists have long distinguished between physical capital

and human capital, some have recently extended this scheme to include

natural capital (see theme #40). Capitalism

involves 1) private individual or

corporate ownership of capital goods, 2) private rather than state

control of investment, and 3) pricing, production and distribution of

goods (for the most part) by agents or forces operating within the free

market system.

Those embracing "Economic Individualism" believe each

individual should be allowed to make economic decisions with little or

no government interference. Big

fans of laissez faire capitalism and its 20th century neoclassical

economics incarnation, they abhor collectivism

and socialism. They

believe the free market

system is far superior to any centrally planned economy in producing and

allocating goods and services.

The participants in the free market system are ideally thought of

as independent economic agents

behaving rationally: individuals seeking to maximize utility (satisfaction

derived from a particular purchase) or

businesses aiming for maximum profits.

They do this by buying and selling factors of production: land

(including natural resources), labor, and capital.

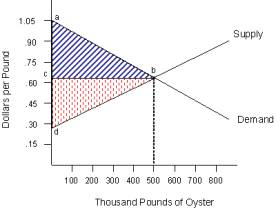

Prices in the free market system fluctuate according to supply

and demand. In actuality,

it is composed of many individual markets where individuals and firms

buy and sell a specific good or service—such as the oysters charted in

Figure #19.

In such markets, buyers can be thought of as (all together

through their independent actions) establishing a demand curve: a plot

of the price they are willing to pay for a commodity vs. the number of

commodity units they demand.

This curve pro-vides the details of the general observation that

as prices fall the demand rises. Sellers

similarly establish a supply curve: a plot of the price they will charge

for various amounts of commodity units.

This curve provides the details of the general observation that

if they can get higher prices, sellers will rush to make more of the

commodity available—whereas if prices are low

they have little incentive to do so.

Where demand and supply meet —where their curves

intersect—determines the commodity's so called equilibrium price.

This is the price that can be maintained. If prices fall below that price there is excess demand,

which |

Discussion—continued soon leads to a price increase.

If prices rise above equilibrium price, sales fall, increasing

supply, leading to a price decrease.

In establishing this price, the free market also in effect

allocates resources: giving commodities to those who can pay for them,

and withholding them from those lacking in money or desire.

The market system can be modeled as a closed system, with capital

flowing into production, and output being consumed— increasing utility

for some and capital for others. Production efficiency is linked to

productivity—production output per unit of input. A business's profits can be reinvested to make labor and

capital more productive. Overall

economic efficiency can be

achieved by either minimizing costs while maximizing production, wisely

allocating consumption related expenditures to maximize consumer

satisfaction, or a combination of both.

The market system has been called "one of the

most extra-ordinary social inventions in human history."

In arguing this, economists Robert Heilbroner and Lester Thurow

note how its development overcame significant problems of pre-market

societies based on 1) tradition and 2) authoritarian command.

The former ones were "inert, passive, changeless," the

latter ones "[given] the presence of political power in the

economic mechanism [were] an endless source of economic

inefficiency."

Left alone, the market system can provide a dynamic,

self-enforcing framework for economic transactions among knowledgeable,

rational, independent agents to occur and for economic problems to

naturally work themselves out. When

those agents are ignorant, have perverse, irrational expectations

(perhaps due to unfounded rumors or panic), or work in collusion with

others, markets can fail. This

can also happen when public

goods are involved, and/or economic problems cross some line and become

social, environmental, or health ones. Then public demand can force

governments to act for the common good, to right social or environmental

wrongs. Where

markets fail to allocate adequate resources to poor

people—pricing them out of participating—governments often step in.

When businesses or markets fail and governments intervene, free

markets become not so free! Some

intervention is accepted by nearly everyone: laws to support the market

system (maintaining the monetary system, enforcing contracts, private

property rights, etc.) and its competitive framework (combating fraud,

unfair monopoly, etc.) Beyond

that, economic individualists disdain government meddling to set prices,

provide subsidies, bailout private firms in exchange for an

ownership stake, etc. They

often oppose raising taxes to fund social programs—which social

welfare states (theme #49A) depend on.

They especially don't like programs to redistribute income.

With the global economic crisis casting doubt on "markets

know best," by 2009 many governments were looking

beyond neoclassical economics to restore prosperity.

In the USA, in particular, it was not a fun time to be an

economic individualist! |

|

Figure

#19 How the

Market Sets the Price Through Supply and Demand

from

NOAA Coastal Services Center

|

|